What Type of Business Uses Financial Statements?

While anything with a dollar sign may be considered a financial statement by some, the term ‘financial statements’ is used in accounting and in business as a specific set of financial reports that businesses prepare at recurring intervals—monthly, quarterly, or annually. Regardless of the size of your business, they’re essential.

Implementing procedures and processes to create financial statements routinely will help businesses prosper in the long run. Together, these sets of reports help users make investment, funding, and operational decisions so approaching them with that mindset can make producing and utilizing them much less intimidating.

Financial Statement Report Set

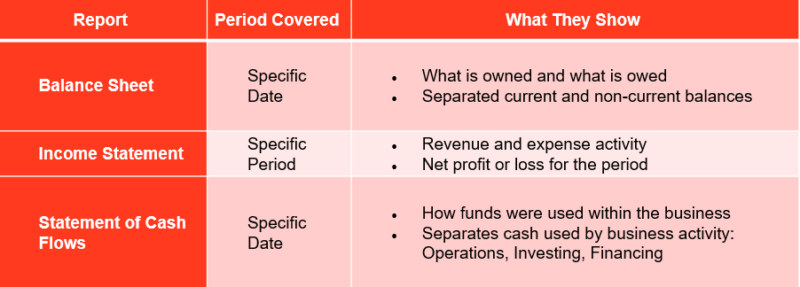

For all businesses, financial statements include three reports. For some, an additional report—the statement of shareholders’ equity—is also prepared. The chart below shows the type of financial statement report, period covered and included items.

Internal Use of Financial Statements

Financial statements are used within a business by owners, managers, and board members to make strategic and operational decisions. The statements summarize underlying transactions and account balances to show both the state of the business at points in time and the business activity that has occurred within the period.

Businesses often customize their reports—the income statement in particular—to show activity by division, location, or product line. This can help to isolate which areas are more profitable and which may need more support to gain the traction that was expected.

External Use of Financial Statements

Whether a business is closely held and owned by a single individual, family, or millions of shareholders, there is often a need to share a company’s financial statements with those outside of the organization.

Public companies—those traded on a stock exchange—are required to publish their financial statements so investors and prospective investors can understand how the company is uses its resources. This allows the readers to make buy and sell decisions with their investment dollars.

Nonpublic companies frequently require outside funds to scale their business. When securing lines of credit for working capital and construction loans, lenders require that you provide financial statements to help so they can judge whether loaning the funds is a wise decision. Likewise, investors also need them to learn how owners are using their current funds and help them decide if choosing investing in your business over another is the right move.

Footnotes in Financial Statements

While financial reports consist of dollar values, balances, and sales and expense summaries, wise users of financial reports also pay special attention to the footnotes provided with the reports.

Internal financial statement users know the details of the operations more intimately but as businesses scale and add locations, new divisions, and new layers of responsibility, the footnotes will become more valuable.

External users use footnotes to learn whether businesses are operating on a cash or accrual basis (this will be noticed in the line items of the reports also), what assumptions were made, and potential liabilities that may present a risk to the user (e.g. a pending lawsuit that may not have been accrued for within the report would be disclosed in the footnotes.) Vendors and service providers may also request financial statements to extend credit terms to your business.

Financial Ratios, Horizontal and Vertical Analysis

Important financial ratios and percentages can be incorporated within financial reports or presented separately. They provide rapid assessments of the activity or balances, enabling users to draw faster conclusions.

In horizontal analysis, one time period is compared with another across a report or actual results are compared with forecasted amounts. Users can then to spot trends and can highlight anomalies more quickly.

Vertical analysis compares one number to another (or to a set of numbers) within the same accounting period. A company’s gross margin percent—a ratio comparing the cost of goods sold to sales revenues—is an example of vertical analysis.

Other financial ratios, such as the debt-to-equity ratio and days sales outstanding are also important for businesses to take note of. Some important business ratios are more operational in nature and require using values not typically presented within the financial statement, such as the number of employees, products, or values from different service lines.

Thorough, Accurate, and Timely

Producing financial statements are a critical part of managing your business for operational evaluation and potential funding needs. Thoroughness, accuracy, and timeliness are important considerations. In order for your statements to be relied upon, those tenants must be followed, or the integrity and the usefulness of the statements will falter.

Continue the Conversation

We help privately owned businesses in a variety of industries prepare their financial statements. If your company needs support producing or interpreting your financial statements and could benefit from expert advice with your financial statement process, contact Clayton & McKervey today for a complimentary consultation with our Audit & Assurance team.