Managing international operations, employees and contractors requires a high level of due diligence to ensure that all return filing and payments are completed before their deadlines. Adhering to all requirements and making certain that each calculation is accurate may require significant time, especially as we approach the end of the year.

Managing international operations, employees and contractors requires a high level of due diligence to ensure that all return filing and payments are completed before their deadlines. Adhering to all requirements and making certain that each calculation is accurate may require significant time, especially as we approach the end of the year.

Foreign individuals who work in the United States must acclimate to the Internal Revenue Service (IRS) guidelines, while also learning about any specific state or local regulations or payments that may be required of them. Planning and preparing documentation and any supplemental information you may need should start now if it is not readily at hand.

FDAP Payment Annual Returns

Business owners who have withheld, collected and remitted federal income tax funds for U.S. source income for foreign individuals are reminded that the Annual Withholding Tax Return—Form 1042—is due on March 15, 2023. All Fixed, Determinable, Annual, Periodical (FDAP) cash payments are considered income and are reported on a cash basis.

Any overwithholding of funds found to have been more than the amount due may be adjusted and remitted back to the recipient if not deposited. If the tax deposit was completed, the reimbursement procedure or set-off procedure can be done to adjust the withholding.

FDAP Expense Tax Deductions

Employers making FDAP payments to foreign parties can deduct certain types of income that have been paid out by year end, such as interest and royalties. Tax treaties need to be consulted to determine which exceptions are permitted. Because FDAP is reported on a cash basis, tax regulations also have some exceptions. In this situation, a detailed analysis is required to determine the exact tax deduction.

FinCEN Form 114

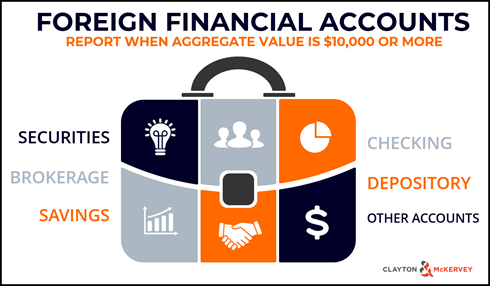

The U.S. Department of Treasury’s Financial Crimes Enforcement Network (FinCEN) works to safeguard the country’s financial system. As part of that effort, all U.S. persons that have a financial interest in or signature authority over foreign financial accounts are required to file FinCEN Form 114 when the aggregate value of the foreign account(s) or individual transactions exceed $10,000.

Reportable financial accounts include securities, brokerage, savings, demand checking, savings, depository, time deposit or any other account maintained with any type of financial institution.

FinCEN Report 114—also known as FBAR (Foreign Bank & Financial Accounts)—is submitted annually to the Department of Treasury. It can be completed and submitted entirely online or be downloaded and completed offline before final submission and is required to be filed by April 15 annually in the year following when the $10,000 threshold was met. An automatic extension is granted to extend the filing date to October 15 for those who have failed to file.

FinCEN Report 114—also known as FBAR (Foreign Bank & Financial Accounts)—is submitted annually to the Department of Treasury. It can be completed and submitted entirely online or be downloaded and completed offline before final submission and is required to be filed by April 15 annually in the year following when the $10,000 threshold was met. An automatic extension is granted to extend the filing date to October 15 for those who have failed to file.

Staying Compliant

Additional paperwork is rarely welcomed but working with international employees and business partners exposes us to a new range of talent that may not otherwise be available. If your organization would benefit from receiving assistance or guidance in following international tax regulations or managing foreign employees, Clayton & McKervey can help ease your way into adapting to the global marketplace. Contact us today to learn more.