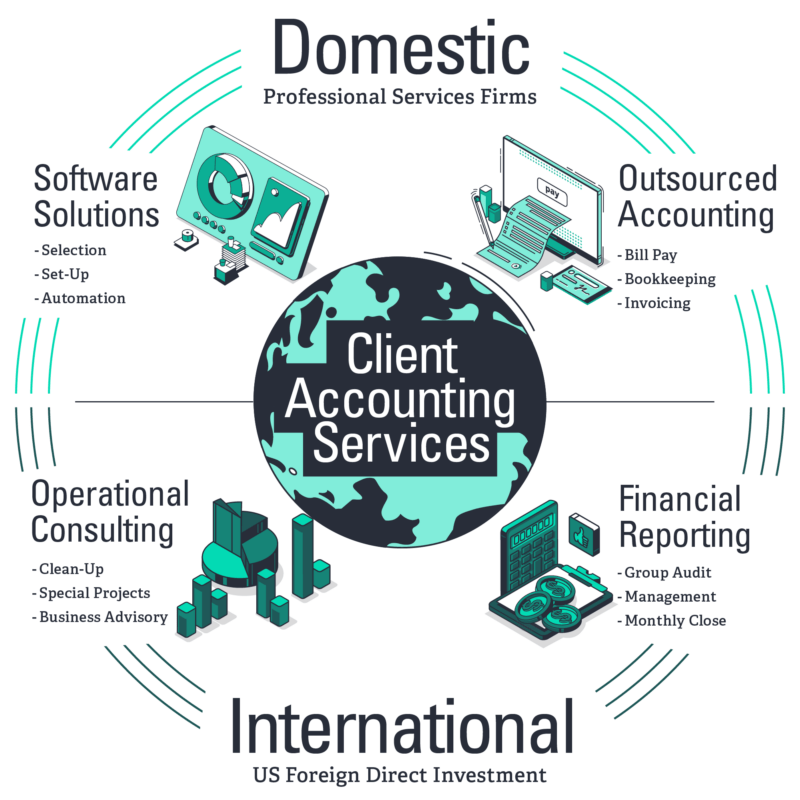

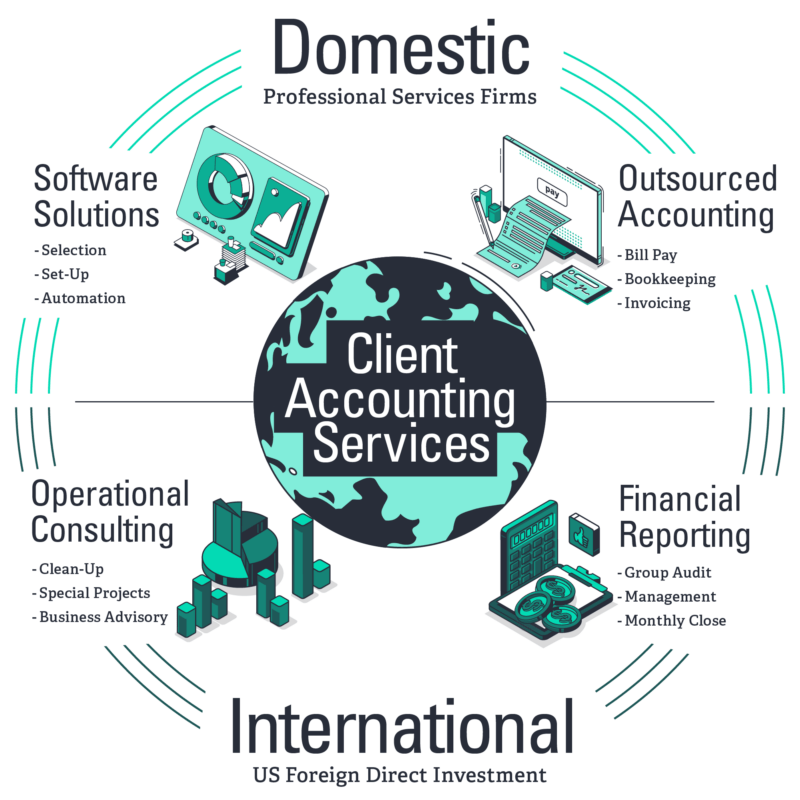

Outsourced Accounting & Reporting

As a cost-efficient extension of your team, we can help streamline your accounting and reporting responsibilities.

Beth Butchart

Director, Client Accounting Services

Beth leads the firm's client accounting services group, serving domestic and international companies at all stages of growth.

Teresa Gordon

Shareholder, International

Teresa leads the firm's international group and supports global businesses through all phases of growth as they expand to and from the U.S.

Accounting Support

Structuring the right support for your growing company

We provide a broad range of accounting, bookkeeping and general business support tailored to your needs. The cloud options available support the successful outsourcing of your accounting functions to fill any gaps in your resources. We will spend time to understand your current and planned needs to structure the right support for your growing company. You may need us to:

- Be your accounting department, especially when just starting up

- Train your personnel on accounting software and best practices

- Coordinate the set-up and on-going business services such as banking, payroll, employee benefits, and insurance

- Reconcile, adjust and close the books of the company on a monthly, quarterly or annual basis

- Provide financial reporting to U.S. and group management

- Advise management in a controller capacity

Software Solutions

Cost-effective solutions that work across town and across the globe

Dedicated to supporting foreign-owned companies starting up and expanding to the U.S., we help identify the accounting software solution that’s right for your stage of operations while meeting the reporting requirements of the global group. Cost effective solutions may include the use of cloud accounting applications or hosting environments with the following benefits:

- Remote access for users around the globe

- Real-time access to results

- Customizable reports to match group reporting

- Automation of transactional activity such as bill approval and payment

- Cloud access to manage time and expense reporting with synchronization to the general ledger software

- Outsourcing of accounting functions

Reporting

Specialized reporting for foreign-owned subsidiaries

Accounting and reporting services have proven particularly valuable to international companies. We’ve worked with enterprises from all over the world to help them understand the requirements U.S. subsidiaries must satisfy in order to meet the needs of foreign parent companies. We can help prepare the proper reporting documents for your foreign parent or group auditor, and provide specialized reporting for individual subsidiaries.

Tools to Support Your Business

Teresa Gordon

Shareholder, International

Teresa leads the firm's international group and supports global businesses through all phases of growth as they expand to and from the U.S.

Beth Butchart

Director, Client Accounting Services

Beth leads the firm's client accounting services group, serving domestic and international companies at all stages of growth.

Want to Learn More?

Discover more insights around Client Accounting & Reporting directly from your team members.