America’s bonus depreciation addiction is scheduled to end. It may not be “cold turkey” but all businesses need to review the pending changes and related tax and cash flow impacts, especially considering a potential business slow down and/or recession.

Bonus Depreciation

The current bonus depreciation tax incentive allows a business to immediately deduct 100% of the purchase price of eligible assets, such as machinery, rather than write them off over the “useful life” of that asset.

Internal Revenue Code (IRC) Section 179 expensing is also available but is limited to approximately $1.0M per year and is phased out ($1 for $1) once the capital acquisitions exceed $2.7M.

Therefore, most capital-intensive businesses (like manufacturing entities) utilized the bonus depreciation tool to “kick the tax can” down the road since they took bonus depreciation on all new capital expenditures and dramatically reduced or even eliminated their taxable income and related tax liabilities.

However, the bonus depreciation deduction is scheduled to begin a 20% reduction/phase-out in 2023 with the elimination of the bonus deduction starting in 2028.

But it phases out in 2028, why worry now?

The reason for the concern is the perfect storm of a possible economic slowdown combined with a reduction in the bonus depreciation amount available, resulting in unexpected tax liabilities due to the “reversal” of the depreciation “timing difference”.

What is a depreciation “timing difference”?

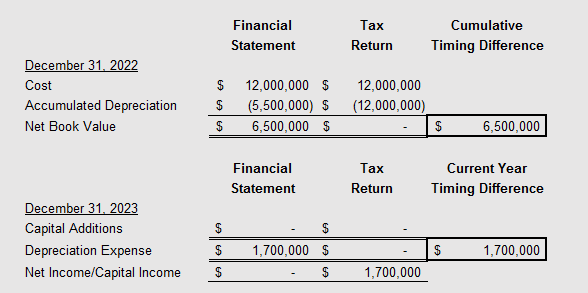

The depreciation timing difference is the cumulative difference between the depreciation taken on your financial statement (e.g., straight-line over the useful life of the asset) versus accelerated and/or bonus depreciation on the tax return. The depreciation timing difference times your effective tax rate is the deferred tax liability that you need to monitor.

The “reversal” is when the depreciation on your financial statement is higher than the depreciation deduction available on the tax return. For example:

In this example, we experience an economic slowdown, stop acquiring new equipment, and the financial statement income is break-even after deducting the $1.7M of depreciation. The company has already fully depreciated the assets for tax purposes and therefore is unable to deduct the $1.7M of depreciation on the tax return which would result in taxable income and related taxes being due.

We recommend that all companies, especially flow-through entities (S corporations, LLCs, partnerships) where the deferred tax liability is NOT recognized on the financial statement, perform an analysis of the timing difference and related reversal to identify potential tax impacts well before the taxes are due.

Continue the Conversation

If you’d like to learn more about the pending bonus depreciation withdrawal and related tax and cash flow impacts, please reach out.